| Security | Interest Rates |

| 91 – Day Bill | 15.2333% |

| 182 – Day Bill | 15.7783% |

| 364 – Day Bill | 16.9591% |

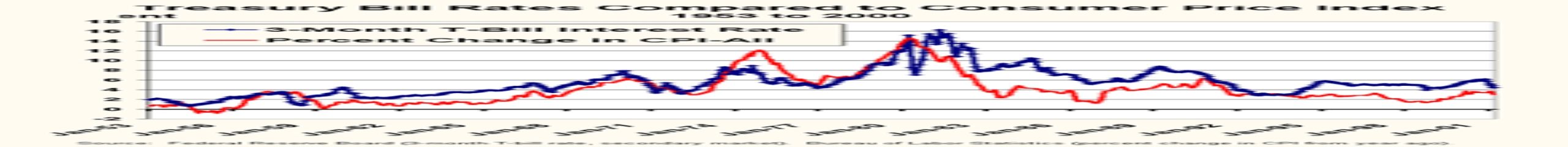

Ahead of the release of the consumer price index, due later in the week, the yields on the government’s short-term securities maintained their downward trajectory, albeit at a much faster pace this week compared to the previous week, on growing expectations that the inflation rate will register its fourth consecutive dip in April. Despite the mounting anticipation that inflation is likely to see a decline, soaring food and commodities prices will be expected to trim gains from decline in the prices of petroleum products at the pump. Although Treasury yields are likely to continue their downward trend in the near term, yields are expected to be much stable in the medium term.

The yield on the 91-day bill edged down by 9 basis points (bps) to send its year-to-date decline to 45.96%. It cleared at 15.2333% this week, down from 15.3209% posted last week.

The 182-day dropped by 26 bps this week to build on last week’s 15 bps drop. It fell from 16.0380% posted last week to clear at 15.7783% this week.

The 364-day bill sustained its biggest weekly drop in eight weeks this week, down by 1.41 percentage points. It plunged from 18.3705% posted last week to clear at 16.9591% this week.

Week-on-Week Change

| Tenor | Previous | Current | w-o-w Change | w-o-w Change (%) | Year-to-Date |

| 91 – Day | 15.3209% | 15.2333% | -0.09 | -0.57% | -45.96% |

| 182 – Day | 16.0380% | 15.7783% | -0.26 | -1.62% | -45.44% |

| 364 – Day | 18.3705% | 16.9591% | -1.41 | -7.68% | -43.75% |

Auction results of tender 1953 showed that investors expressed their resentment towards the fast drop in Treasury papers at a time when inflation remained over five percentage points above Treasury yields. Consequently, the government’s target amount was undersubscribed by 16.29%.

A total of GHS 5,292.93 million worth of bids were tendered for the 91, 182, and 364 tenors against the government’s target amount of GHS 6,323.00 million. The government accepted all GHS 2,985.08 million worth of bids tendered for the 91-day bill, and also accepted 76.93% and 74.78% of the total GHS 869.04 million and GHS 1,438.81 million worth of bids tendered for the 182-day and 364-day bills, respectively.

In the week ahead, we expect the government to return to the domestic market in an attempt to mobilize GHS 5,386.00 million from 91-day, 182-day, and 364-day bills to meet GHS 4,709.94 million worth of maturing papers due next week.

![Weekly GoG Treasury Bills News Report – Week 08 [February 23, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eTBills-scaled-768x480.jpg)

![Weekly GoG Treasury Bills News Report – Week 07 [February 16, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/epicsart_12-29-02-20-28-scaled-768x480.jpeg)

![Weekly GoG Treasury Bills News Report – Week 06 [February 9, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/edrecon_00-12-scaled-768x480.jpg)

![Weekly GoG Treasury Bills News Report – Week 05 [February 2, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2022/02/treasury-bond-1-768x480.jpg)

![GoG Treasury Papers News – Week 46 [November 17, 2025]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eTreasury-bills-notes-and-bonds-scaled-768x480.jpg)

![Currency News [May 9, 2022]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eCur1-scaled-768x480.jpg)