| Security | Interest Rates |

| 91 – Day Bill | 14.7922% |

| 182 – Day Bill | 15.4590% |

| 364 – Day Bill | 15.7991% |

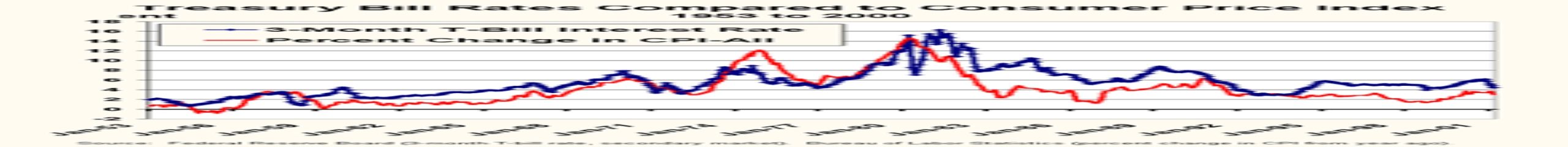

Treasury bill rates extended their downward streak this week as the latest inflation print supported the ongoing decline in the yields on the government’s short-term papers. Consumer prices data released last week showed that the inflation rate for May registered its biggest drop since January 2024 to its lowest in more than three years. The improvement in the consumer price index has been supported by the strengthening of the local currency against some of its peers, a slump in the prices of petroleum products, and reductions in transport costs. It is expected that the sustained drop in inflation will continue to support the ongoing softening of Treasury yields.

The yield on the 91-day bill was little changed this week, recording a tiny drop after plummeting by 13 basis points (bps) last week. It fell to 14.7922% this week, down from 14.7949% posted last week.

The 182-day bill similarly posted a modest performance, edging down by 3 bps this week, after recording a 7 bps drop last week. It cleared at 15.4590% this week from 15.4855% posted last week.

The 364-day bill sustained the biggest decline this week, down by 11 bps to build on last week’s 9 bps drop. It fell from 15.9128% posted last week to clear at 15.7991% this week.

Week-on-Week Change

| Tenor | Previous | Current | w-o-w Change | w-o-w Change (%) | Year-to-Date |

| 91 – Day | 14.7949% | 14.7922% | 0.00 | -0.02% | -47.53% |

| 182 – Day | 15.4855% | 15.4590% | -0.03 | -0.17% | -46.54% |

| 364 – Day | 15.9128% | 15.7991% | -0.11 | -0.71% | -47.60% |

Auction results of tender 1958 revealed that the recent inflation print, coupled with expectations of further drops in the inflation outlook, sent shivers down the spine of investors as they sought to look for other investment options other than the government’s Treasury to enhance their returns. Consequently, the government’s target amount was once again undersubscribed, with an undersubscription rate of 17.96%, worse than last week’s 9.06%

A total of GHS 5,471.04 million worth of bids were tendered for the 91, 182, and 364 tenors against the government’s target amount of GHS 6,669.00 million. The government accepted 75.63%, 92.68%, and 30.82% of the GHS 3,507.58 million, GHS 1,806.28 million, and GHS 157.18 million worth of bids tendered for the 91-day, 182-day, and 364-day bills, respectively.

In the week ahead, we expect the government to return to the domestic market in an attempt to mobilize GHS 7,588.00 million from 91-day, 182-day, and 364-day bills to meet GHS 7,317 million worth of maturing papers due next week.

![Weekly GoG Treasury Bills News Report – Week 09 [March 2, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eTreasury-bills-notes-and-bonds-scaled-768x480.jpg)

![Weekly GoG Treasury Bills News Report – Week 08 [February 23, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eTBills-scaled-768x480.jpg)

![Weekly GoG Treasury Bills News Report – Week 07 [February 16, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/epicsart_12-29-02-20-28-scaled-768x480.jpeg)

![Weekly GoG Treasury Bills News Report – Week 06 [February 9, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/edrecon_00-12-scaled-768x480.jpg)

![Weekly GoG Treasury Bills News Report – Week 05 [February 2, 2026]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2022/02/treasury-bond-1-768x480.jpg)

![Currency News [May 22, 2023]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2022/02/download-768x480.jpg)

![Currency News [May 9, 2022]](https://theparkstone.sgcancerghana.com/wp-content/uploads/2019/11/eCur1-scaled-768x480.jpg)